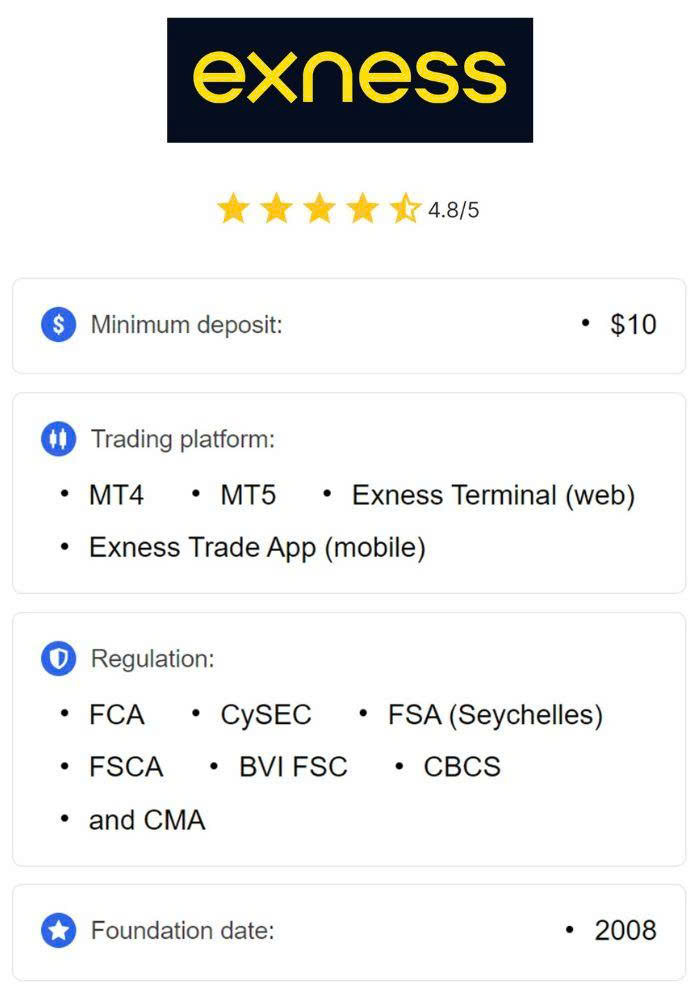

When it comes to online trading, having a reliable and convenient way to fund your account is vital. Exness, a well-established forex broker, offers a variety of exness deposit options Exness deposit limit options tailored to suit the needs of traders from different backgrounds. Understanding these options and their specifics can significantly enhance your trading experience. This article will delve into the various deposit methods available on the Exness platform, the advantages they provide, and guidance on how to use them effectively.

Understanding Exness Deposit Options

Exness provides several deposit methods, each with its own features in terms of speed, fees, and availability based on your location. These options include bank transfers, credit/debit cards, and various e-wallets. Choosing the right deposit method is crucial for optimizing your trading journey.

1. Bank Transfers

Bank transfers are one of the most traditional deposit methods and are often preferred for larger transactions. They provide a high level of security, but it’s essential to keep in mind that they may take longer to process compared to other methods. Exness supports bank transfers from many countries, making it accessible for numerous traders.

When using bank transfers, ensure that you have the correct bank details provided by Exness. In some instances, there may be fees imposed by your bank for international transactions, so it’s advisable to verify these before proceeding.

2. Credit and Debit Cards

Using credit or debit cards is one of the most popular ways to deposit funds into your Exness account. This method offers near-instant processing, allowing you to start trading quickly. Exness accepts various major cards, including Visa and MasterCard.

One of the benefits of card deposits is that they typically come with low to no fees; however, transaction limits may apply. Always double-check your card limits and Exness’s policies to avoid unexpected interruptions during your trading activities.

3. E-Wallets

E-wallets have gained significant popularity in the online trading community, and Exness partners with several leading providers. Common e-wallet options include Skrill, Neteller, and WebMoney. These services enable quick deposits and withdrawals, catering to traders seeking efficiency.

Setting up an e-wallet account is usually straightforward. Once your account is active, you can link it to your Exness trading account for convenient fund transfers. Remember to consider any fees that may apply when utilizing these services, although many e-wallets offer promotions or lower transaction costs for certain users.

4. Cryptocurrencies

As cryptocurrencies gain traction globally, Exness has adapted by allowing deposits through various crypto wallets. This method is particularly appealing to traders who prefer digital currencies over traditional fiat. With the growth of cryptocurrency, you can quickly deposit funds into your trading account and enjoy potential benefits from crypto market movements.

However, it’s essential to stay updated on the specific crypto options Exness supports, as these can vary and may involve different processing times and fees. Ensure your wallet is properly configured and ready for transactions.

5. Regional Payment Methods

Exness caters to a global audience, and for this reason, they include deposit options that vary by region. This means that traders in certain countries may have access to local payment methods that facilitate easier deposits. For instance, this can include local bank transfers, regional e-wallets, or mobile payment solutions.

To find out about specific regional options, it’s best to log into your Exness account and check the deposit methods available based on your locality. Exploring these options can provide you with the best possible experience that suits your needs.

Choosing the Right Deposit Method

Selecting the optimal deposit method will depend on several factors, including your location, the amount you wish to deposit, and your preferred speed of transaction. Here are a few tips to guide your decision:

- Transaction Speed: If you want to begin trading immediately, consider methods with faster processing times, such as credit/debit cards or e-wallets.

- Fees: Always be aware of any potential fees associated with different deposit methods. Some options may be less expensive than others.

- Security: Ensure that the payment method you choose offers adequate security features to protect your funds.

- Deposit Limits: Take note of any minimum or maximum deposit limits imposed by the method you choose, so you can manage your funding effectively.

Conclusion

Exness provides a broad range of deposit options designed to accommodate both novice and experienced traders. By understanding the characteristics and requirements of each method, you can optimize your funding process and minimize any potential hiccups. Whether you prefer traditional bank transfers, instant card deposits, or digital currencies, Exness has a solution that can fit your trading needs. Always remember to stay informed about any changes to deposit methods and associated fees, ensuring that you are making the most of your trading experience.